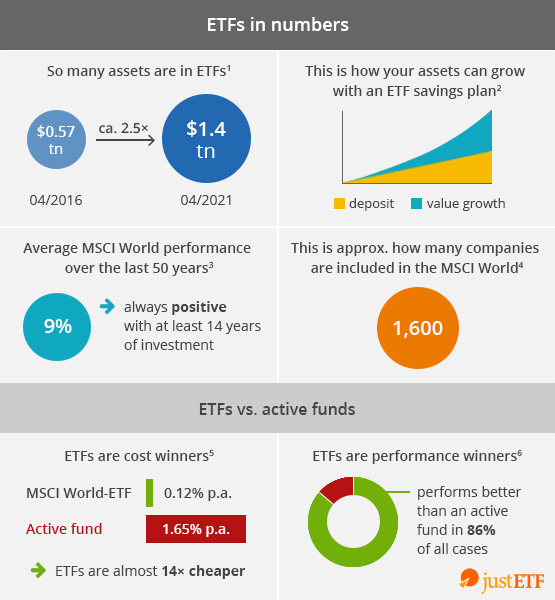

You might be new to the investment world and have just started researching. During your research, it is possible you will see a lot of different investment types, including ETF investing. One of the type of investment that people recommend the most is ETFs. ETFs are a great way for diversification, but they might provide lower returns if you were to choose individual stocks. ETFs are less risky, but they provide steady value without you having to worry about anything.

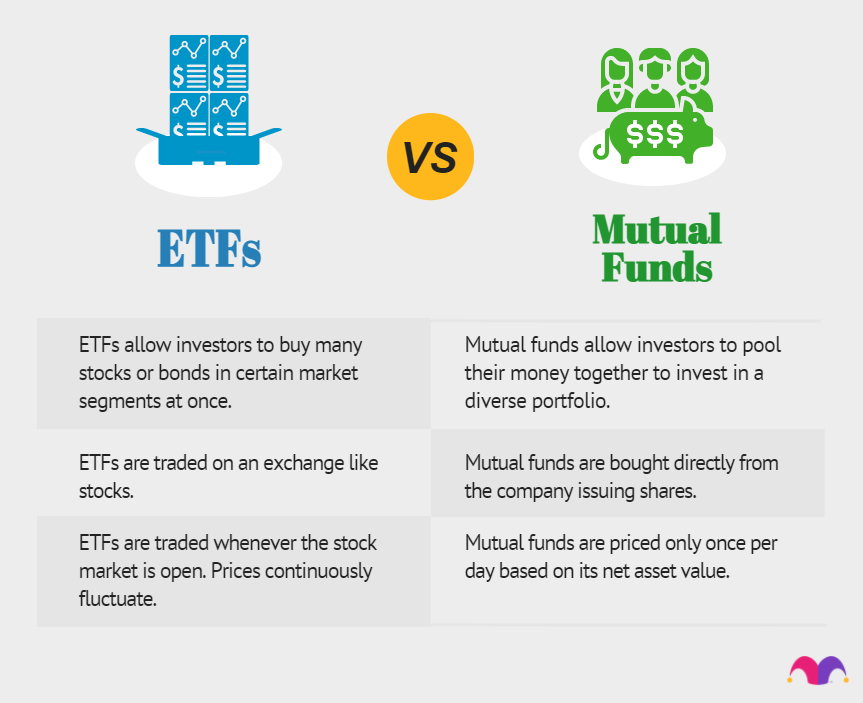

An exchange-traded fund (ETF) is an investment asset with many different securities in it that functions similarly to a mutual fund. ETFs often follow a specific index, sector, commodity, or other assets, but unlike mutual funds, ETFs may be bought and sold on a stock market in the same way that conventional stocks can.

An ETF can track anything from a single commodity’s price to a huge and diversified group of commodities. ETFs can even be designed to follow certain strategies. The SPDR 500 ETF (SPY), which tracks the S&P 500 Index, was the first ETF and is still an actively traded ETF today.

What is ETF Investing and ETF Types

An ETF is a form of investment that invests in a variety of underlying securities. Since an ETF contains several assets, it can be a common pick for diversity. ETFs can thus hold a variety of investments, such as equities, commodities, bonds, or a combination of investment forms.

An ETF might own hundreds or even thousands of equities across many industries, or it can be limited to a single industry or sector. Some funds solely sell products in the United States, whilst others have a global vision. Banking-focused ETFs, for example, would own equities from various banks throughout the industry.

An ETF is a marketable investment, which means that its share price permits it to be purchased and traded on exchanges during the day, and you can sell it short.

Individual investors can choose from a variety of ETFs that can be utilized for revenue generation, speculation, and price gains, as well as to hedge or partially offset risk in an investor’s portfolio. Here is a quick summary of some of the ETFs that are currently available on the market.

- Passive and Active ETFs

ETFs are classified as either passive or actively managed. Passive ETFs seek to imitate the results of a wider index, such as the S&P 500, or a more specialized focused sector or trend.

Active management ETFs do not normally track an index of stocks but rather rely on portfolio managers to decide which assets to include in the portfolio. These funds offer advantages over passive ETFs, but they are more expensive for investors. Below, we look at actively managed ETFs.

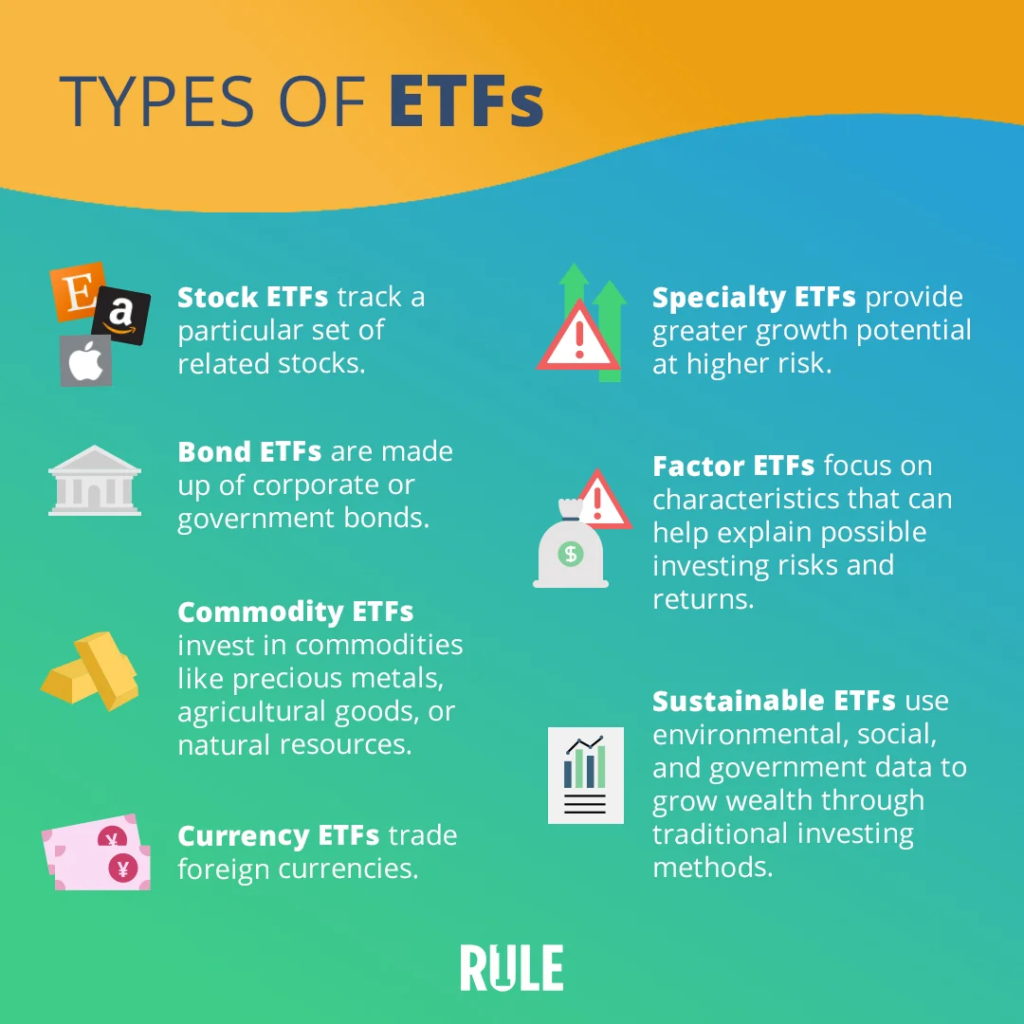

- Bond ETFs

Bond ETFs give investors consistent income. The performance of the fundamental bonds influences their income distribution. Government bonds, business bonds, and state and local bonds are examples. Unlike their underlying products, bond ETFs do not have a maturity date.

- Stock ETFs

Stock (equity) ETFs are a collection of equities that track a certain industry or sector. A stock ETF, for example, may follow automotive or international equities. The goal is to give diverse exposure to a particular industry that includes both excellent performers and new entrants with development potential.

- Industry ETFs

Industry ETFs specialize in a certain area or business. An energy sector ETF, for example, will contain firms in that industry. The objective behind industry ETFs is to acquire exposure to the upside of a certain industry by following the performance of firms in that field.

- Commodity ETFs

As the name suggests, commodity ETFs invest in commodities such as crude oil or gold. Commodity ETFs provide various advantages. To begin with, they diversify a portfolio, making it easier to hedge against downturns.

- Currency ETFs

Currency exchange-traded funds (ETFs) are collective financial products that follow the performance of currency pairings, which include both local and foreign currencies.

- Inverse ETFs

Shorting stocks allows inverse ETFs to profit from stock falls. Shorting a stock is selling it with the expectation of repurchasing it at a lower price. In order to short a stock, an inverse ETF employs derivatives. They essentially wager on the market falling.

- Leveraged ETFs

A leveraged ETF tries to outperform the underlying investments by a factor of two or three. For example, if the S&P 500 grows 1%, a two leveraged S&P 500 ETF will rise 2%. (and if the index falls by 1 percent, the ETF will lose 2 percent )

How to Invest in ETFs?

Puttying your money in ETFs is rather easy because most brokerage platforms offer ETFs along with individual stocks. However, there are many different types of ETFs with different fees, exposures, and other variables.

- Find a brokerage platform that offers ETFs

- Find the ETF you want to invest in (which company’s ETF you want and how much fee you want to pay)

- Buy the ETF and let it sit in your account until you want to sell it

How do ETFs Work?

An ETF provider develops an ETF using a certain technique and offers shares of that fund to investors. The provider purchases and sells the ETF’s component securities. Even though investors do not own the underlying assets, they may be entitled to dividends, reinvestments, and other advantages.

So, you basically own the fund rather than the individual companies or assets that the fund has. The fund’s price fluctuates depending on the holdings of the fund, as the fund you are buying holds these assets to determine the price of the fund.