Bonds are rather popular in investing for a safe return investment instrument. Many people ask should you invest in bonds and how much should you invest in bonds. There are many different answers to these questions. All in all, it boils down to personal choice. Because bonds are relatively safe investment instruments. Compared to stocks, commodities, or other investment choices, volatility is lower and risks are also low. However, they do give low returns than the majority of investment choices.

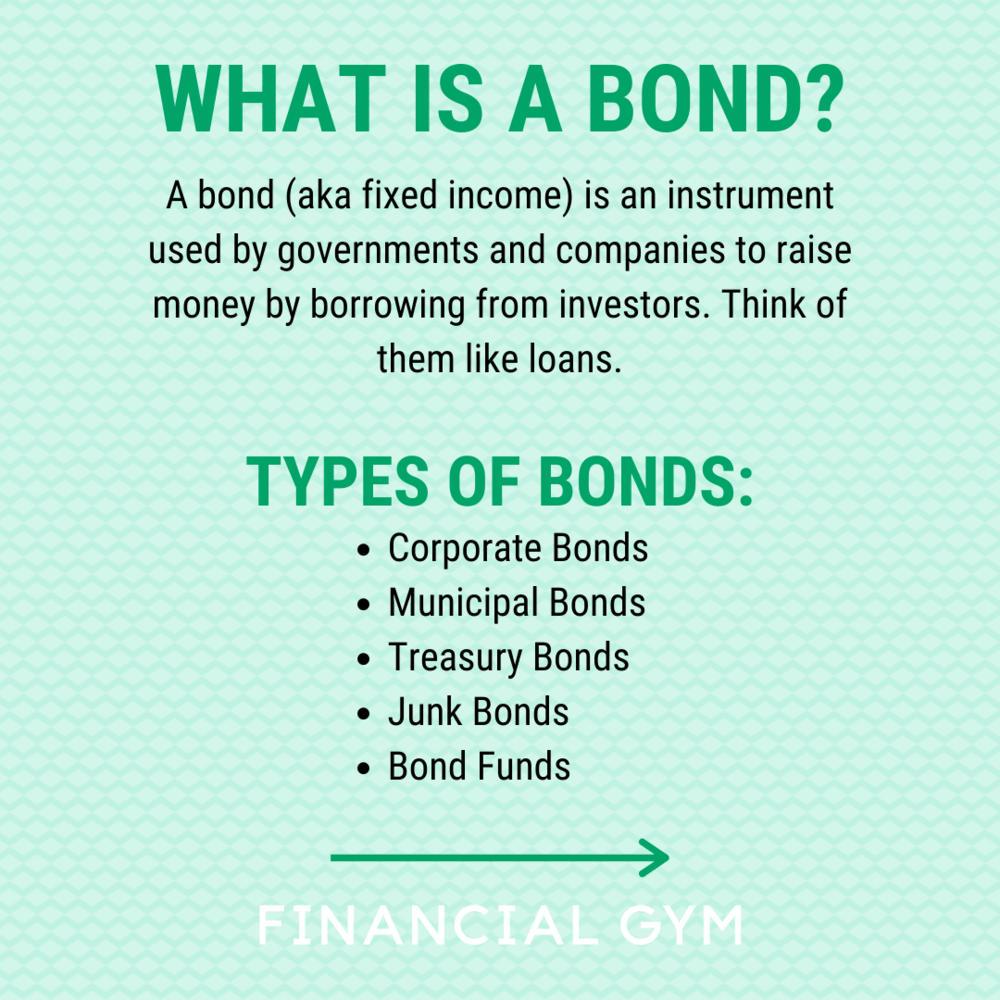

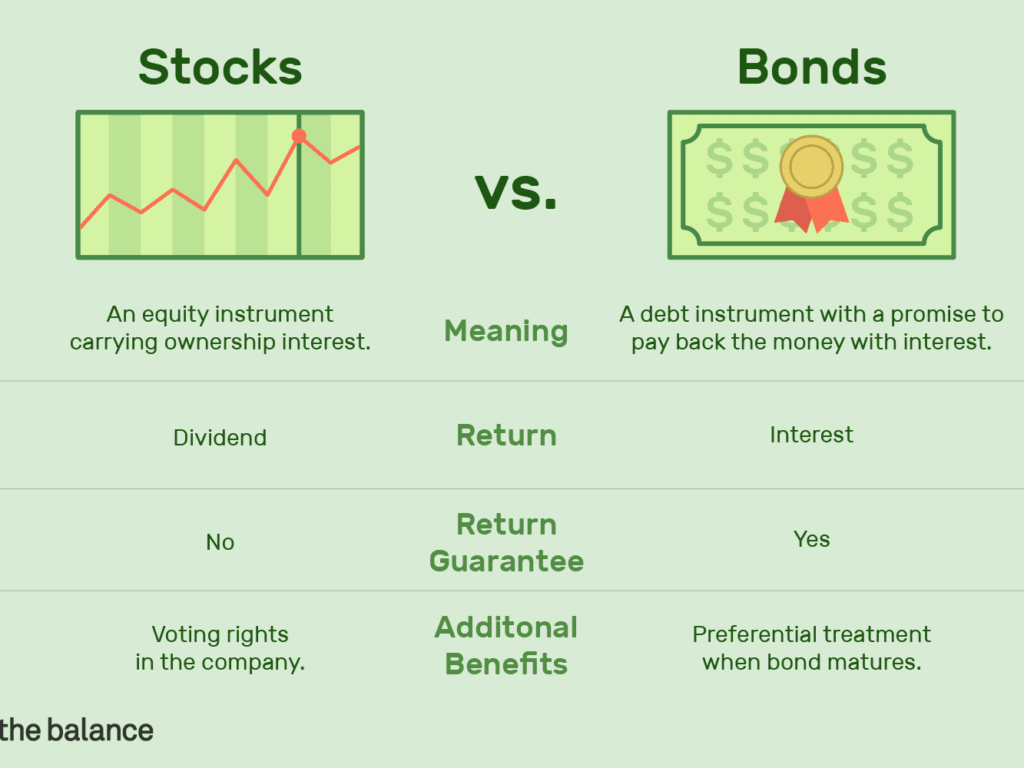

Bonds are debt instruments enterprises and governments issue to raise cash. Investors purchase bonds by making an initial investment known as the principle. The investors get back their money when the bond expires or matures (called the maturity date). In exchange, the issuing corporation pays investors a fixed, monthly interest payment. Bonds, like T-bonds, can be a good investment for those looking for a consistent interest payment. Bonds and Treasury bonds are popular. But they have inherent drawbacks and dangers that may not be suitable for every investor.

Are bonds a good investment?

So, is it a good idea to invest in bonds? Investors must examine various aspects. The type of bond, the amount of interest they will get, and the length of time investors’ will lock up their money. These are all important considerations. Investors must also balance their risk level with the possibility of a bond default. This means the lending institution will not be able to reimburse the investment. The best part is that Treasury bonds (T-bonds) are government-guaranteed. They can be suitable investments for seniors in or nearing retirement mostly. Younger investors looking for a consistent return could also choose bonds.

Why should you not invest in bonds?

It is not always should you invest in bonds, but you should also ask yourself why should you not invest in bonds. Bonds are, after all, not for everyone. Bonds may be a terrific way to produce income and are typically seen as a secure investment. Especially when you compare them to stocks. However, investors must be aware of the risks of holding corporate and government bonds.

A bond investor should first know that interest rates and bond prices are inversely related. Bond prices soar when interest rates fall. Bond prices often decline when interest rates rise. When interest rates are falling, investors want to capture or lock in the greatest yields they can for as long as they can. They will buy existing bonds with greater interest rates. Bond prices rise in response to the increase in demand.

Another risk that bondholders confront is reinvestment risk. This is the risk of having to reinvest earnings at a lesser rate than the funds were earning earlier. One of the most common ways this risk comes up is when interest rates decline over time. This happens and issuers exercise callable bonds.

When an investor purchases a bond, they effectively agree to get a fixed or variable rate of return. This return is throughout the duration of holding that bond. And what if the cost of living and inflation rise more than the income of the investment? When this happens, investors’ buying power erodes. They may even get a negative rate of return when you take the inflation into account.

Can you lose money investing in bonds?

Trading Losses

When you buy and sell bonds as a trader, it’s possible to lose money. Like stocks or commodities, attempting to trade fixed-income securities might cause you to lose money. Because their prices fluctuate during the day. And if the situation allows it, they might fluctuate by a lot. That’s why always avoid trading bonds and only invest in them for long-term. That’s what they are for and you can’t mostly even trade bonds to begin with.

Inflation

Inflation is your next chance to lose money. In a nutshell, you are losing money if you earn 5% per year on your fixed-income portfolio, but inflation is at 6%. That’s all there is to it. There are Treasury inflation-protected securities (TIPS). Sometimes known as “real return bonds” by Canadian investors. These bonds serve to be the solution to the inflation problem. Whether they can actually be the solution or not depends on the actual situation of the economy. They might provide well but it’s still a risky move.

Mortgage-Backed

John Smith’s monthly mortgage payments secure mortgage-backed securities (MBS). He may fail on his mortgage if he experiences personal financial difficulties or if the value of his home decreases dramatically. If enough people follow him, your MBS will lose a lot of value and probably a lot of liquidity. You will lose money when you ultimately decide to sell it—if you can sell it at all. This is what happened in the subprime mortgage crisis of 2008-09, to the tune of billions of dollars.

When should you invest in bonds?

When is it good to invest in bonds? At some point during an investor’s career, everyone will consider bonds. It is not wrong that every investment portfolio must consider devoting a part of cash to bonds. This is because bonds provide steady and reliable cash flows (income). Cash flow is critical for an investor all the time. Especially in the asset depletion or capital preservation phase of their investment plans. It is equally important for individuals reaching that stage. In a nutshell, if you rely on investment income to pay your bills and everyday living expenditures (or will in the future), you should invest in bonds.

Bonds are an important part of any long-term investment strategy. Don’t allow the stock market’s volatility to wipe out your life savings. Bonds are a good option if you rely on your assets for income or plan to do so in the near future. Make relative value comparisons based on yield when you decide to invest in bonds. But while doing that, make sure you understand how a bond’s age and attributes affect its yield. Most essential, research and comprehend key benchmark rates. Learning the 10-year Treasury could be a good starting point. This research will help you to place each possible investment into the correct context.

What Happens to Bonds When Interest Rates Go Up?

Recently, to slow the economy, the Fed is raising short-term interest rates. Now that the bond market is beginning to predict lower long-term inflation, Treasury bond yields have fallen from their peak. In 2022, the interest rate environment shifted substantially. While the benchmark 10-year US Treasury note yielded 1.5% at the end of 2021, it had risen to 3% by May. It kept flirting with 4% in late September, a level not seen since April 2010.

Because there is an inverse link between bond rates and bond prices, investors saw this as a negative development. When rates rise, the prices of existing bonds on the market decline. This is all about supply and demand. When demand for bonds falls, issuers of new bonds must offer greater yields to attract new buyers. They do this by lowering the value of existing lower-yielding bonds. This atmosphere had a significant impact on bondholders for much of the year.

Long-term growth and inflation trends tend to influence interest rates. Rising interest rates are frequently associated with higher inflation. However, as inflation rates soared during 2021, the bond market looked to react slowly. Many events in 2022 changed the environment for investors. Ranging from persistent supply limitations for products to a large change in monetary policy by the Federal Reserve (the Fed). Russia’s invasion of Ukraine didn’t help either.

Are Higher Interest Rates Good for Bonds?

When you hear “the national interest rate” or “the Fed,” it usually means the federal funds rate. This rate is the rate established by the Federal Open Market Committee (FOMC). This is the interest rate levied on interbank transfers of funds held by the Federal Reserve (Fed). It is commonly used as a benchmark for interest rates on all types of investments and debt securities.

Bond prices are heavily influenced by Fed policy actions. For example, when the Fed raised interest rates by a quarter percentage point in March 2017, the bond market plummeted. Within a week, the 30-year Treasury bond (T-bond) yield declined from 3.14% to 3.04%. The 10-year Treasury note (T-note) rate went from 2.60% to 2.43%, and the two-year T-note yield fell from 1.40% to 1.27%.

Bond investors, like all investors, normally seek the highest possible return. To achieve this, they must generally keep track of the changing borrowing costs. Consider zero-coupon bonds. These bonds do not pay monthly interest. They instead derive all their value from the difference. This difference is between the purchase price and the par value paid at maturity. This is an easy way to understand why bond values move in the opposite direction of interest rates.

Should You Buy Bonds During Inflation?

There are controversial opinions about this issue. Some say that inflation is a time to hold cash. Others say that you should focus on buying bonds at the time of inflation. And there are also people saying to stick to your normal investing strategy. I agree with the last one. You should stick to whatever it is you’ve been doing. But there are some risk-averse people. For them, keeping cash could be the best option. After all, even though bonds do give you a certain cash-flow, you might still lose your capital’s value.

There are inflation bonds, often known as I-Bonds. Purchasing these inflation bonds, is an appealing option for investors. They help to have a direct hedge against inflation. These Treasury bonds pay monthly interest that is a combination of a fixed rate and the inflation rate. This rates are modified twice a year. As a result, yields rise as inflation rises. I bonds issued between May and October 2022 yield 9.62%.

The I Bonds can be a safe inflation hedge but they do not help everyone. One significant disadvantage is the annual purchasing limit of $10,000. This buying constraint is especially not good for larger investors. Some investors may also have worries about I Bonds’ lack of liquidity. I Bonds, rather than paying out regular interest payments, only pay out when you sell them. This is only can happen at least 12 months after purchase. Otherwise, the bonds mature 30 years after issuance and pay off.

What Are the Best Bonds to Invest in 2022

The bonds here are only for informational purposes. They are in no way investment advice. I encourage you to make your own research before making a purchase. But these are some of the most popular and frequently invested bonds in 2022.

iShares Inflation Hedged Corporate Bond ETF (LQDI)

Yield 2.86%

3-Yr Avg. Annualized Return 0.3%

Vanguard Total International Bond ETF (BNDX)

Yield 3.54%

5-Yr Avg. Annualized Return 0.1%

iShares Interest Rate Hedged High-Yield Bond ETF (HYGH)

Yield 5.11%

5-Yr Avg. Annualized Return 2.62%

iShares 0-5 Year TIPS Bond ETF (STIP)

Yield 6.75%

5-Yr Avg. Annualized Return 2.53%

Vanguard Short-Term Corporate Bond ETF (VCSH)

Yield 1.68%

5-Yr Avg. Annualized Return 1.22%