No matter which background you are coming, protecting your money is a top priority. However, protecting this money i not easy feat. To protect and grow your money, there are many different options. One of the most common ways is to invest in stocks. If you don’t know how to invest in stocks, learning how to invest in stocks for beginners might take some time. There are many information related to stocks and goal-planning.

Investing in stocks was not easy in the past and you had to do a lot of things to learn how to start investing in stocks. However, investing in stocks became more accessible in the last few years. Beginners can start an account with minimal money via a brokerage’s website or mobile app. Learning how to invest in stocks for beginners also became easier through these brokerages.

There are many different reasons to invest in stocks. Learning how to invest in stocks for beginners might feel tough because it seems complicated. Nevertheless, it is actually not. You just need to get familiar with investment planning and what fits your goals the best. We will talk about how to start investing in stocks for beginners and which methods are available.

What are Stocks?

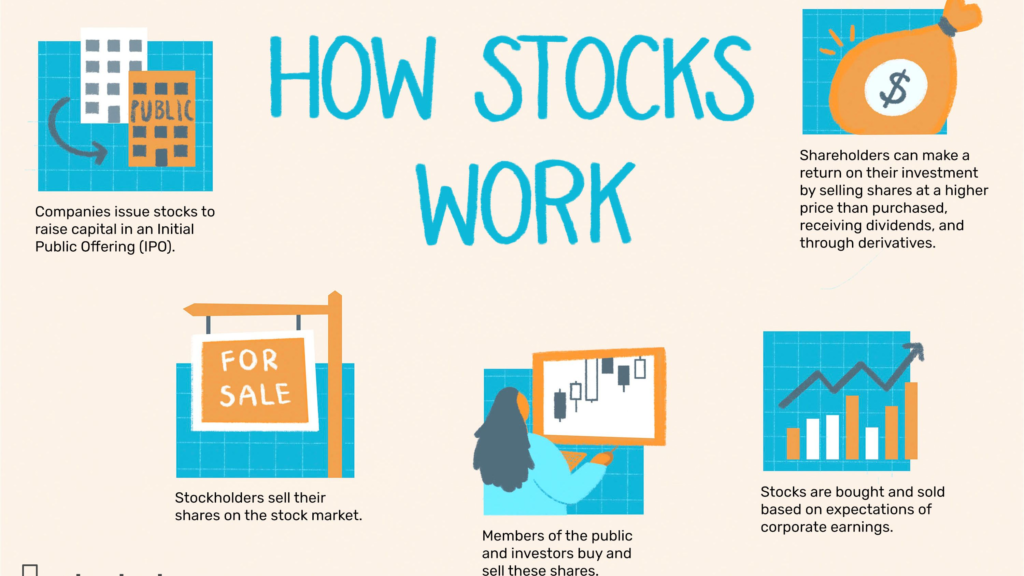

A stock symbolizes a common shareholder’s ownership position in a corporation. Shareholders of common stocks can vote on corporate matters. Most corporations allows one vote per share if you own a certain amount of stocks within a company. Some corporations also pay dividends to owners. They provide investors with a source of income in addition to the stock’s market value. These payments are usually adjusted accrdoing to the company’s profitability.

You can mostly buy and sell stocks on various stock exchanges. Stock tradings must follow government standards to protect investors from dishonest tactics. In order to raise money to run their operations, corporations issue stock. Holder of those shares are shareholders. They might have the right to get some of the company’s assets and earnings.

How Do You Want to Invest?

When you are investing in the stock market, there are some options. These options are about who will manage your investments. You can do it yourself which is what the general population chooses to do. There are also experts helping you to find the right stocks and manage the entire process for you. Or alternatively, you can start investing in your employer’s 401k which is another popular investing method for beginners.

Do It Yourself Method

This is as simple as it gets. You follow the traditional steps that will talk about later on in this article. It is also probably the hardest method to go for. The reason for that is because you are doing everything on your own. From choosing your brokerage to buying what you want to invest in. This method requires a massive amount of upfront research and you also need to spend good amount of time continously. However, this is probably the less costlier and with highest authority on your investment choices.

Working With an Expert To Manage Your Investments

There are two different versions of working with an expert. One is working with a human expert. They are expensive but can guide you through better. You talk to them about your investing habits, long-term and short-term goals, what you can afford to invest in, etc. Once they have enough information about you, they steer you towards a certain portfolio. Even though they generally tell you what they are doing, you don’t indulge in the portfolio and let the expert do their work.

Second option is the robo-advisor. Nearly every brokerage is offering them and they are either free or cost less than a human expert. They invest your money based on your specific goals. With robo-advisors, they don’t try to understand you. They only work with the goals you give them. Even if that goal is not the right fit for you, they will still do it because you told them to.

Investing in Employer’s 401k

This is among the most usual strategies for new investors to get started. It teaches new investors how to invest using for long-term. When investing in 401(k), you make regular contributions. It helps you to build an investing habit. You keep an eye on the big picture, and maintain a hands-off attitude. The majority of 401(k) plans provide access to a small number of stock mutual funds but not to individual stocks.

That is why if you are planning on having a portfolio with a lot of individual stocks and diversificate however you wish, 401(k) might not be the best fit. If you want to have a simple portfolio of mutual funds and do not think about it constantly, go for 401(k). That is why 401(k) is the best option on learning how to invest in stocks for beginners.

Choosing a Brokerage to Invest in Stocks

Very first step to starting to invest in stocks is to choose a brokerage. Brokerages are companies and websites allowing you to invest in stocks. While choosing your brokerage, it is important to go for something that is safe and has a big library. Brokerages might not have all the stocks, bonds, ETFs that you can invest in.

However, thanks to the increasing interest on stocks, there are many different brokerages. They help you start investing easily with a good choice of equities.

What to Look for When Choosing a Brokerage

Start by checking out the brokerage companies that work in your location. Most US brokerage companies do not work in Europe or most Europeans don’t work in the US because of tax and other legal issues.

You need to check the fees they have. Some brokerages might have massive fees and not everytime they openly tell you what they are. There might be hidden fees or something that you are overlooking. Talk to people using the brokerage and determine if they have hidden fees.

Another important thing to look at is if they have fractional shares or not. If you don’t have a big capital to start with, you will need fractional shares. Fractional shares allow you to buy a fraction of a stock. For example, if you have $200 but the stock you want to buy is $400, you can’t normally buy that. With fractional shares, you can buy 0.5 of that share for $200. If you don’t buy a very small portion of it, you are eligible for everything that normal shareholders are like dividends.

Last thing is to check how many stocks they offer. As I mentioned above, not every brokerage offers every equity. Some have the ETF you are looking for but not the stock. Generally blue chip and most traded stocks and ETFs are available on every brokerage. But if you are going for a niche ETF, mutual fund, or a stock, better check it seperately.

Determine How Much You Want to Invest

Right before starting your journey, you will need to determine how much money you can afford to invest in stocks. If you opt for investing all the excess money from your paycheck, that is a big mistake. You shouldn’t invest all the excess savings on your paycheck. You also shouldn’t invest your emergency fund. That’s why start with creating a plan for your finances first. How much emergency fund do you need? While funding your emergency fund, how much can you afford to invest? Once you finish your emergency fund, how much should you keep investing?

Your Emergency Fund Before Starting to Invest in Stocks

Before anything else, determine your monthly costs, understand how much you spend annually. Once you know this number start building an emergency fund of 6-12 months. Stock market is not a safe area to be in, there might be massive drops. Seeing your capital deprecating is a big chance. That’s why having cash emergency fund to cover your expense for the next year is extremely important in case something happens. Focus heavily on building this fund, put most of the excess money from your paycheck into this fund.

Find the Right Percentage and Start to Invest in Stocks

Once you fund your emergency fund, now it is time to put your feet on the gas and start putting more money into stocks. However, you still shouldn’t put all of your excess money into stocks. Take your spendings into account and see how much you spend on groceries, rent, and going out. Determine how much percentage you have at the end of the month as excess. Try to put 5% or 10% into your emergency fund again and put the rest to your investment account.

You can still put all of your excess money into stocks after you have a good emergency fund. However, being safe never hurts. Slowly increasing your emergency fund to help with inflation could be a good way to keep your emergency fund at bay. A good rule of thumb is investing 30% into stocks or 15% depending on your income and how much excess money you have.

Finding an Investment Strategy to Invest in Stocks

You need to figure out a strategy once you establish your brokerage preference and open your account. There are many different things that you can explore, I explained most of the strategies in detail here. However, let me give some ideas as to what kind of strategies that you can choose and employ with your finance journey. Here are some small explanations of some strategies:

- Dividend Investing: Dividend investing is for those looking for a steady cash-flow from holding stocks of certain companies. You do not have to touch your capital. All you need to do is to invest in frequent intervals to increase your cash-flow without being subject to the changes in the capital you invest. That’s why dividend investing might be the perfect choice for passive investors. I believe this strategy to be the best one can do with their personal finances. I explained that reason in one of my articles here.

- Trading: Trading is one of the most riskiest investment strategies. The sudden changes in the market affects you the most. There is a chance that you could lose all your money in a day if you are not careful. Trading focuses on buying and selling a certain stock in the hopes of making a profit. This profit comes from either buying and selling the stock or by taking a long or short position. Both are risky but the latter is more riskier.

- Growth Investing: Another risky strategty is to find and buy stocks that you have hope to grow in the future. Typically within five to ten years. These stocks are generally extremely volatile. There is also the risk of their prices not increasing if they go down. After all, hey are not a solid company with solid mangamenet and financial history.

Picking the Stocks

Once you determine your brokerage and strategy, it is now time to find the stocks that you will be investing in. If you are going to go for ETFs, the indexing strategy, that might be easier as there are lot less ETFs than individual stocks on the market. All you need to do is to figure out the sector or the index you want to invest in and find the most suitable one.

However, if you are going for individual stocks, things might get complicated. You first need to find the companies and stocks that fits within your strategy. Let’s say you are going to invest in dividend stocks. You first need to narrow your search with dividend paying stocks. After that, you need to figure out if you are going for high-yielding stocks (not recommended at all) or growth dividend stocks.

Growth stocks are stocks with the potential to increase both in value and in dividend yield. You can narrow your search by putting in a minimum and maximum yield on your search (like 1% to 5%). Then, you will find companies that you know and understand their business. After that, you will take a look at their financials to see if they are doing well.

These are the steps to determine to pick a stock to invest in. You need to be aware of many details when it comes to financial statements, so it is worth to learn about financial dictionary and what means what.