Are you looking for a new and exciting investment opportunity? Have you considered the world of digital real estate? In this increasingly digital age, owning online properties can be just as lucrative as owning physical real estate. If you’re intrigued by the idea of investing in digital properties such as websites, blogs, and online businesses, this blog post is for you.

In this comprehensive guide, I will show you the details of digital real estate, from understanding what it is and why it’s worth investing in the various types of digital properties you can acquire. We’ll also provide practical tips on how to buy digital real estate, including selecting the right property and navigating the process of purchasing it.

An Overview of Digital Real Estate

Digital real estate is a relatively new concept that has gained significant traction in recent years. To fully grasp the potential of this investment opportunity, it is essential to have a comprehensive understanding of what digital real estate entails.

At its core, digital real estate refers to the ownership of virtual properties, such as websites, blogs, online businesses, and social media accounts. These digital properties can generate income through various means, including advertising revenue, affiliate marketing, product sales, and sponsored content.

The rise of the internet and the increasing reliance on digital platforms for commerce, communication, and entertainment have paved the way for the emergence of digital real estate. Digital properties can increase in value and give you passive income through rent, just like physical real estate can.

One of the key advantages of digital real estate is its scalability. Physical properties are limited by geographical constraints, but digital properties can reach a global audience easily. This means that the potential for growth and profitability is virtually limitless.

However, digital real estate comes with its challenges, too. The online landscape is dynamic and ever-changing, requiring constant adaptation and staying up to date with industry trends. It also involves a level of technical proficiency and marketing knowledge to effectively manage and grow your digital properties.

The Basics of Digital Real Estate

Like everything in life, you must know the basics of digital real estate before starting your digital real estate journey. Fundamental aspects of digital real estate, including its definition, why it is worth investing in, and the different types of digital properties you can consider, are all some of the important parts you need to know.

What is Digital Real Estate?

Digital real estate refers to virtual properties that hold value and generate income in the online realm. These properties can include websites, blogs, online stores, social media accounts, and digital platforms. Similar to physical real estate, digital properties can be bought, sold, and managed to generate revenue and increase in value over time.

Why Invest in Digital Real Estate?

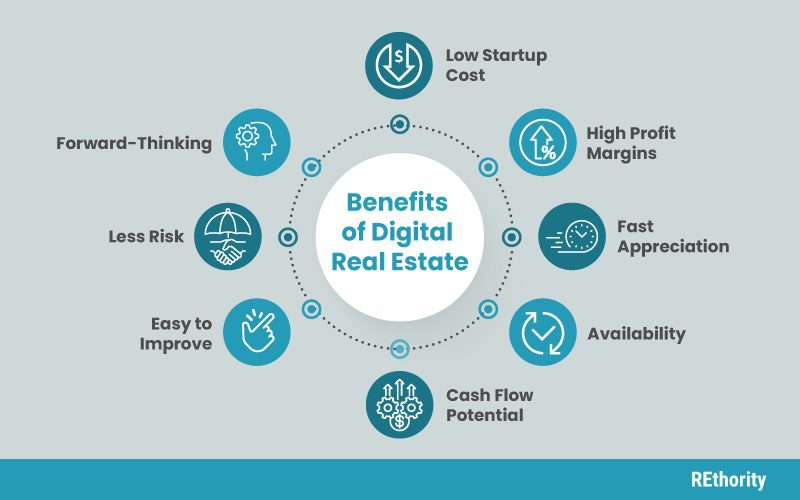

There are several compelling reasons to invest in the world of digital properties:

- Potential for Passive Income: Digital properties can generate passive income through various monetization methods such as advertising, affiliate marketing, sponsored content, and product sales. Once your digital property is established and attracts a steady flow of traffic, the potential for passive income becomes significant.

- Global Reach: Unlike physical properties, which is limited by location, digital properties have the advantage of reaching a global audience. This opens up opportunities for scaling your business and tapping into diverse markets worldwide.

- Lower Initial Investment: Compared to traditional real estate, investing in digital properties often requires a lower initial investment. With the right strategies and market understanding, you can find affordable digital properties that offer a substantial return on investment.

- Flexibility and Scalability: Digital real estate provides flexibility in terms of managing and growing your investments. You can choose to focus on a specific niche, expand your portfolio, or diversify your holdings. The scalability of digital properties allows for unlimited growth potential.

Types of Digital Real Estate Investments

There are various types of digital properties you can invest in, each with its own unique characteristics and potential for profitability. Here are a few examples.

- Websites and Blogs: Owning and operating a website or blog can be a lucrative investment. These properties can generate income through advertising, sponsored content, affiliate marketing, and product sales.

- E-commerce Stores: Online stores offer the opportunity to sell products and services directly to consumers. With the growth of e-commerce, investing in an e-commerce store can be a profitable venture.

- Social Media Influencer Accounts: Social media platforms like Instagram, YouTube, and TikTok have created a new avenue for digital real estate investment. Influencer accounts with a large following can attract brand partnerships, sponsorships, and endorsement opportunities.

- Online Businesses: Acquiring established online businesses can be a strategic investment. These businesses may already have a customer base, revenue streams, and existing systems in place, allowing you to hit the ground running.

How to Buy Digital Real Estate

If you’re ready to dive into the world of digital real estate, you’ll need to know how to buy digital properties effectively. You have to go through phases like acquiring digital real estate, including selecting the right property, understanding domain ranking and traffic, and the steps involved in purchasing a digital property.

Choosing the Right Digital Property

When it comes to buying digital real estate, selecting the right property is crucial for a successful investment. Consider the following factors:

- Niche and Market: Identify a niche that aligns with your interests, expertise, and market demand. Research the potential profitability and competition within that niche.

- Traffic and Metrics: Assess the website or digital property’s traffic and engagement metrics using tools like Google Analytics or third-party platforms. Look for consistent traffic, organic search rankings, and a loyal audience.

- Revenue Potential: Evaluate the revenue potential of the digital property by analyzing its current income streams, such as advertising, affiliate marketing, or product sales. Consider the scalability of these revenue streams.

- Unique Value Proposition: Look for digital properties that offer a unique value proposition or have a competitive advantage. This could be in the form of exclusive content, a strong brand presence, or a well-established community.

Steps to Purchase a Digital Property

Once you have identified a promising digital property, you can start the process of buying your digital property. But you need to be careful of a few things.

- Perform Due Diligence: Conduct a thorough due diligence process, including analyzing financial records, traffic reports, and any legal or contractual obligations associated with the property.

- Negotiate the Purchase: Negotiate the purchase price and terms with the seller. Consider factors such as the property’s potential, revenue streams, and market conditions.

- Transfer of Ownership: Once the terms are agreed upon, transfer the ownership of the digital property. This may involve transferring domain registration, website files, content, and any associated accounts or assets.

- Post-Acquisition Transition: Ensure a smooth transition by updating website content, transferring revenue streams, and implementing any necessary changes or improvements.

Managing and Growing Your Digital Real Estate Portfolio

Once you have acquired digital properties for your real estate portfolio, it’s crucial to effectively manage and grow your investments. If you don’t manage it, you probably can’t grow it efficiently and effectively lose money in the end.

Maintaining Your Digital Properties

Similar to stock market investing or even physical property investing, you need to maintain and optimize your properties all the time. This will ensure the long-term success of your digital real estate portfolio. Give regular updates. For example, if you own a blog, constantly push new content that your visitors will be interested in.

Check whether your visitors are having a good time technically and if anything is slow on your website. While doing so, make sure that you have all the security measures possible to keep your users’ information secure and your website alive.

As the last step, you need to get constant traffic, organic traffic, to your website. This allows you to get more and more visitors every day without spending any money. Implement search engine optimization (SEO) to improve your visibility in search engine rankings. This includes optimizing keywords, meta tags, and building high-quality backlinks.

Driving Traffic and Increasing Value

To maximize the value of your digital real estate, it’s vital to drive targeted traffic and increase its overall visibility. Do content marketing. Create valuable, informative, and shareable content that resonates with your readers with a content marketing strategy.

Once you have the marketing strategy, start with social media promotion. Develop a consistent brand presence and encourage social sharing. Use email marketing to get the word out about your new content and nurture relationships with your audience.

Consider utilizing pay-per-click (PPC) advertising platforms like Google Ads to drive targeted traffic to your digital properties with search engine marketing. Carefully select keywords and optimize your campaigns for maximum return on investment.

Flipping Digital Properties for Profit

Another strategy for growing your digital real estate portfolio is by flipping properties for profit. Flipping involves acquiring undervalued or underperforming digital properties, improving them, and then selling them at a higher price. Consider the following steps:

- Identify Potential Opportunities: Look for digital properties with untapped potential or those that can be improved through better content, design, or marketing strategies.

- Enhance the Property: Implement necessary improvements, such as redesigning the website, optimizing SEO, enhancing user experience, or creating valuable content.

- Increase Value: Increase the value of the property by boosting traffic, revenue streams, and overall profitability. This may involve implementing new monetization methods or expanding the target audience.

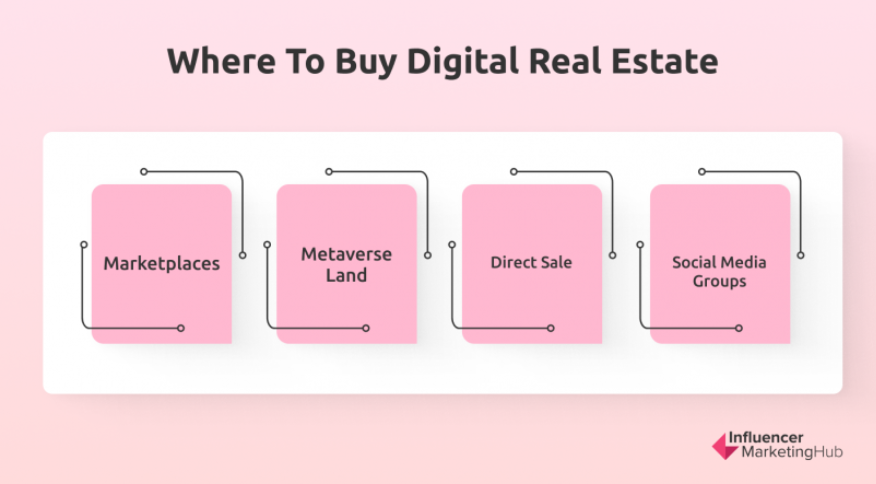

- Sell at the Right Time: Determine the optimal time to sell the property by considering market trends, demand, and potential return on investment. List the property on relevant marketplaces or reach out to potential buyers directly.

By effectively managing your digital properties, driving targeted traffic, and employing strategic flipping techniques, you can grow the value of your digital real estate portfolio.

Risks and Rewards of Digital Real Estate

While digital real estate offers numerous opportunities for growth and profitability, it is essential to be aware of the potential risks involved. Let’s see the risks associated with digital real estate investments, strategies to mitigate these risks, and the potential rewards that await investors.

Potential Risks in Digital Real Estate

- Market Volatility: The digital landscape is constantly evolving, and market trends can change rapidly. Shifts in technology, search engine algorithms, or consumer behavior can impact the value and profitability of digital properties.

- Traffic Fluctuations: Digital properties heavily rely on traffic to generate revenue. Changes in search engine rankings, algorithm updates, or shifts in online trends can result in significant fluctuations in traffic and income.

- Competition and Saturation: As digital real estate becomes more popular, competition in certain niches can become intense. Saturation within a particular market can make it challenging to stand out and generate substantial returns.

- Technical Challenges: Managing digital properties requires technical knowledge and skills. Issues such as website downtime, security breaches, or software glitches can affect the user experience and revenue generation.

- Intellectual Property Infringements: Digital properties can be subject to intellectual property infringements, such as copyright violations or unauthorized use of trademarks. Legal disputes can result in financial loss or damage to your reputation.

How to Mitigate Risks

While it’s impossible to eliminate all risks, there are strategies to mitigate potential pitfalls in digital real estate investments:

- Diversify Your Portfolio: Invest in a variety of digital properties across different niches and revenue streams. This helps to spread the risk and minimize the impact of fluctuations in one particular area.

- Stay Informed and Adapt: Keep up with industry trends, technology advancements, and changes in search engine algorithms. Continuously adapt your strategies to align with the evolving digital landscape.

- Implement Risk Management Practices: Regularly backup your digital properties and implement security measures to protect against data loss or security breaches. Have contingency plans in place to address technical issues and downtime.

- Conduct Thorough Due Diligence: Before acquiring a digital property, thoroughly research its performance, financials, and potential risks. Analyze traffic sources, revenue streams, and legal obligations to make informed investment decisions.

- Seek Professional Advice: Consider consulting with experts in digital real estate investments, legal matters, and online marketing. Their insights and guidance can help you navigate potential risks and make informed decisions.

Potential Rewards and Success Stories

Despite the risks, digital real estate can offer substantial rewards for savvy investors. Some potential rewards include:

- Passive Income.

- Capital Appreciation.

- Flexibility and Freedom.

- Creative Expression.

By understanding and mitigating the risks, digital real estate can offer substantial rewards and opportunities for financial growth.