Growing your wealth, having a better personal finance journey, and eventually retiring early with income are all many people want. It’s easy to say that you should focus on diversifying income streams and making money while you sleep, building passive income over time. However, they are rarely easy in practice.

Creating passive income streams is the best way to make money while sleeping. It helps you to retire early without having to worry about whether you are going to lose your income or not.

There are many methods to make money, but, in their essence, it’s either an active or a passive income. They have their distinctions and serve different purposes for your personal finance journey. Almost all of us have an active income through our 9-5 jobs. That is totally okay but is it sustainable? I assure you, it’s not. Passive income is here to help you with that.

What is Passive Income, and Why Is It Important?

Passive income is an income that requires little to no effort to maintain. You can generate passive income from a variety of sources. Investments, rental properties, and businesses where you mainly do no work at all are some examples. You are basically making money while you sleep. Many people have an interest in passive income streams because it allows them to earn money without working.

You might think that businesses are not a good passive income idea, but they could be. Passive income can also come from businesses where the recipient is not putting in any work. For example, you can invest in a franchise and receive a part of the profits without taking part in the business’s day-to-day operations.

While passive income can be a great way to earn money without actively working, it often requires a significant amount of upfront effort. Building a solid investment portfolio or owning and managing rental properties can take time and resources.

However, for those willing to put in the effort, passive income can provide a stable and ongoing source of financial security. The main aim of passive income is to put the effort in when you are starting and put no effort at all once everything is all ready. All you need to do is to sit back and enjoy the income.

Why Is It Important?

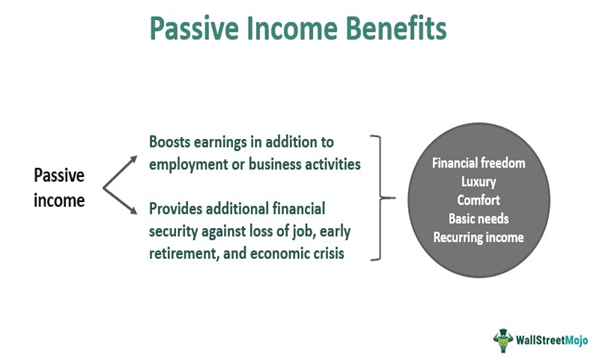

Passive income is important in an individual’s personal finance journey. It can provide a stable and ongoing source of income without the need for active participation. This can be especially beneficial for individuals who have certain goals in the future. Retiring, reducing the work hours, or pursuing other goals that may require a reduction in active income.

In addition to providing a source of income, passive income can also help to diversify an individual’s income streams. This can provide a buffer against economic downturns or job loss. Because the individual has many different sources of income rather than just one.

Passive income can also be a useful tool for building wealth over time. By reinvesting passive income into additional investments or properties, individuals can potentially earn even more passive income in the future. Creating a virtuous cycle of income generation.

What I endorse the most with passive income is that if you are not at the age to retire, you should reinvest your passive income. This means that you keep your passive income, earn money and reinvest them without touching your passive income. You live off of your active income until you hit the benchmark you aim for.

What is the Difference Between Active and Passive Income

Passive income and active income are two different types of income. All types of income are either active or passive income. Understanding the difference between the two types of income can be important. Especially for individuals seeking to build a financial strategy that meets their needs and goals.

Active income is income you earn through the performance of a service or the sale of a product. The most common active income example is traditional employment. An individual earns an income for the time and effort they put into their job. You earn active income in exchange for the direct participation of the individual.

Passive income, on the other hand, is income you earn with little to no effort. Passive income is attractive because it allows an individual to earn money without actively working.

There are pros and cons to both. Active income is reliable and provides a steady stream of income as long as the individual can continue working. However, it also depends on the individual’s ability to continue working. It may not be possible for those who can’t work because of illness, injury, or other circumstances.

Passive income, on the other hand, has the potential to provide ongoing income without the need for active participation. Still, it often requires a significant amount of upfront work and may not provide a steady stream of income.

What is the Benefit of a High Earning Passive Income?

One of the main benefits of high-paying passive income is achieving financial independence. With a passive income sufficient to cover living expenses, you can retire or reduce your work hours without a loss of income. This can provide the freedom to pursue other interests or goals, such as travel, hobbies, or starting a business.

A high-paying passive income or passive income stream can also provide a buffer against economic downturns or job loss. With multiple sources of income, an individual is less reliant on any one source of income. They can weather financial challenges more easily.

What Should You Consider When Choosing a Passive Income Method?

Choosing a passive income stream is not easy. You have to consider many things, from the time you need to spend to the investment you will need to make. There are also other considerations about yourself to see what suits you the best. Here are several things to consider when choosing which passive income streams to pursue. Considering these could help you see which passive income ideas might be the best fit:

Your interests and skills

The two most important things are what you like to do and what you can do. You are in trouble if you choose a passive income method that doesn’t fit into both of these. You must choose passive income streams that align with your interests and skills. This can make the process of building and maintaining the income stream more enjoyable and rewarding.

The potential return on investment

Not every effort you will be making can be profitable. Some could seriously make you lose money. Consider the potential return on investment for each passive income stream. Some passive income streams may have a higher potential return but also come with a higher level of risk. It is important to balance potential return with the level of risk you are comfortable taking.

Time and resources you need to invest

You will need to invest time and resources in whichever passive income idea you choose. You have to know if you can afford to invest in them and whether they will be worth it. Research the amount of time and resources that it will need to build and maintain the passive income stream. Some passive income streams may need a significant upfront investment of time and resources. Others might not require as much.

Legal and tax considerations

Since you will make money off of your passive income stream, you need to be aware of the legal and tax problems. You should ask a few questions about how much tax you will be paying and whether you will need a business entity to pursue this passive income idea. Be sure to research any legal and tax considerations for the passive income stream that you are considering. Some passive income streams may have tax implications or require special licenses or permits.

Sustainability

Consider the sustainability of the passive income stream. Will it provide a stable and ongoing source of income, or is it a one-time opportunity? It might not be worth the effort if it’s not stable enough or it can’t provide an ongoing income. By considering these factors, you can choose passive income streams that fits well to your interests, financial goals, and available resources.

5 Passive Income Ideas 2023

You can choose from tens of different passive income ideas and passive income streams. As I mentioned above, most of them are not the best. They generally require massive energy and time upfront and don’t provide good enough in return. I’ve tried many passive income streams in my personal finance journey. I will list the five best passive income ideas that I think are worth the effort.

Blogging

Everyone has a topic that they like to talk about for hours. If you think you have the ability to put those thoughts into writing, blogging is one of the best options out there. It takes time to build an audience and actually create an income stream. However, once you get it going, it generates endless possibilities for income.

For blogging, you need to be able to write well, understand the topic in detail and write in long-form. You don’t necessarily need website design skills or SEO knowledge, but they are definitely a plus.

Selling an e-book

Nowadays, it’s extremely easy to sell stuff online, especially books. Direct Publishing platforms now allow you to just sell your book for people to buy. These e-books can be either only in PDF format, which you can sell to your audience once you create it somewhere else or in the printed version.

If you use a platform like Amazon KDP, this will come to you at no extra charge. It will be printed when a customer orders it. This makes it extremely easy to start writing and selling. You can think of this method as some sort of a more complex version of blogging.

Create a Podcast

Like blogging, podcasting might be your go-to if you have an interest or just like to talk about anything. Creating a podcast is simple, easy, and extremely fast. You can share your podcast on all the streaming services with just one click.

With consistency, you can pick up an audience in no time. Having a podcast itself might not pay well. However, you can turn your audience into a passive income stream like selling an e-book or affiliate marketing.

Sell Stock Pictures

There are quite a lot of platforms that allow people to list the pictures they took and license them for people to buy. Stock pictures are necessary on every platform you can think of. Websites, blogs, podcasts, YouTube thumbnails, video preparations, books, and many other options. You can generate some income if you can create a good portfolio of stock pictures.

The bad part about this passive income is that you need thousands of pictures uploaded on websites, and it takes a lot of time. Even when you do upload these pictures, it still has some risk of not generating a good amount of income.

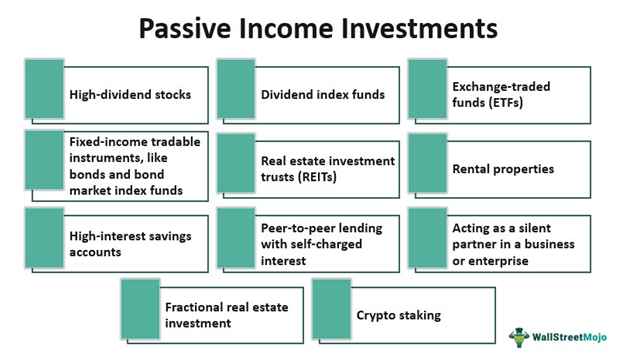

Dividend Investing

One of the most popular passive income ideas is to invest in income-paying stocks like dividend stocks. Dividends are the income you get from holding a specific stock. Depending on the amount you invest, the income you receive proportionally increases.

The worst part about dividend investing is that it takes a lot of time to start getting good income that would be enough to cover your expenses. On top of that, if you want to achieve it in a shorter period of time, you need an extremely high capital to invest, which is another risk as the stocks are volatile, and your capital could lose its value.

Real Estate

I think the best passive income generator is to invest in real estate. You could invest in real estate in many different ways but it’s a truth that it requires massive capital to generate good income. Physical real estate is my favorite, and I think it is the best when it comes to generating income.

You could think that managing a rental house is a lot of work, but it doesn’t have to be. Giving the management of your properties to a management company and paying them a certain percentage of the profits could take all that away.

The Verdict

To conclude, there are many passive income ideas and passive income streams you can do to make money while you sleep. Achieving financial independence and generating income to retire early are important things that good passive income streams can resolve. They take some work and investment upfront, but they are generally worth the effort if you choose the right option.