The stock market plays a big role in most people’s lives. Worrying about is the stock market is going to crash a part of our life. That’s why you should learn about what to do during a stock market crash. In addition, money is the primary issue in everyone’s life. When it is the primary issue, you can’t escape from the concern it brings. Everyone worries about whether they have money or not. These worries depend on your unique situation.

When you have money, you will likely invest in the stock market, at least in the beginning. That is why your worry focuses on the stock market and what to do when the stock market crash. There is no way to predict a stock market crash or a market correction. Yet, investors can use several tactics to lower the impact it has on their investment portfolio.

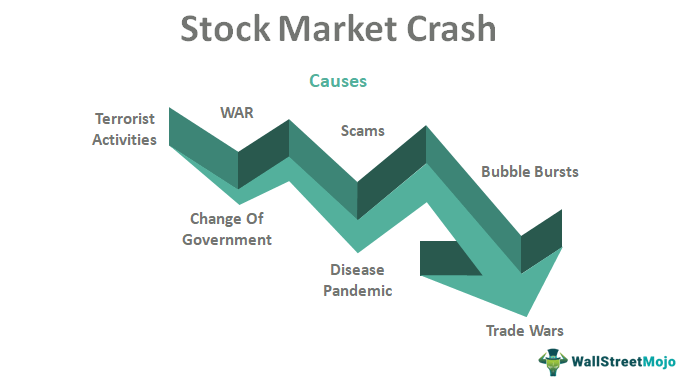

Many things like COVID-19 pandemic, the war in Europe, rising inflation and interest rates affected the stock market. This made veryone asking about when is the stock market going to crash and what to do when the stock market crash. Making a bold statement and saying that the stock market is going to crash could technically be true. Yet, you can never know exactly when the market is going to crash. You must focus on what you can do for yourself and minimize the effect it will have on your portfolio.

Understanding the Mechanics

There are many ways and tactics that you can use to minimize the damages. It is worth remembering that everyone’s goals are different. Not everyone invests in the same thing. Your investments could be in ETFs that focus on the world spectrum. Someone else could focus on individual stocks in various sectors. If you hold individual stocks, you will likely get more damage in terms of your capital.

That is why diversification of your investments is extremely important. However, these crashes in the stock market are generally for the short-term. The market goes up again eventually. Your goals play a bigger role than what you invest. If you are investing for the short-term, you shouldn’t invest in the stock market or go for the safest options (although that is still not 100% safe).

The markets might be hitting all-time highs one day and go to the bottom the next day. You can never know how the financial markets will behave and whether they will be the way it is for a long time. You first need to understand what you invest for your time horizon, and then try looking at what options you can use to minimize your risks. Tactics are not one size fits all.

What Exactly is a Stock Market Crash?

There is no set figure that defines a financial market crash. It is generally a sentiment. People make their moves according to their sentiment how the stock market moves in any given period. Whether long-term or short-term. In addition, there are two terms, bear and bull markets. Bear markets are when the stock market is continuously dropping, and it is vice versa for bull markets.

The stock market’s most recent dramatic crash was when the COVID-19 pandemic first broke out in early 2020. As we said, there isn’t a specific figure that defines a crash. This is just a sentiment because the markets crashed more than 20% in early 2020. The S&P 500 stock market normally fluctuates between -1% and 1% on any given day. For better or worse, you could say that it has been a busy day on the stock market anything outside of these limits.

Indexes could stop for 15 minutes if the S&P 500 falls 7% in a single day. This is an awful day for Wall Street and has only happened a few times in the history of the market. We define a crash when there is a rapi and dramatic decline in stock values that typically occurs after an upward trend. This upward trend is the bull market in the stock market.

Different Various Stock Market Crash in the History

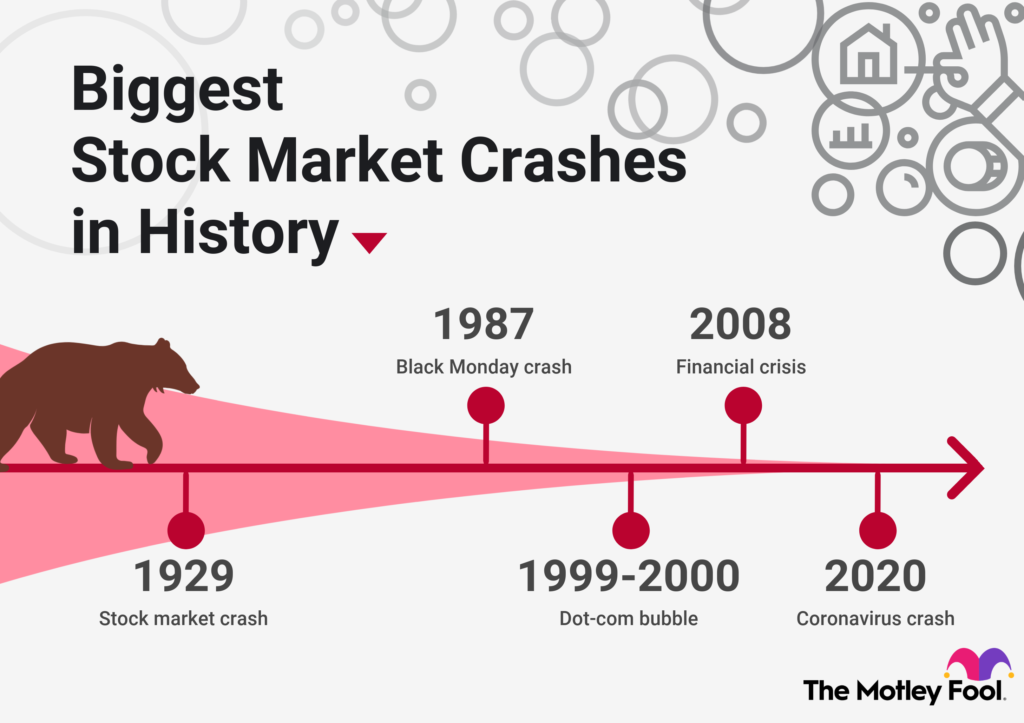

Even though there might seem like there are a lot of crashes, there aren’t that much of major crashes in the stock market’s history. These crashes are the most major crashes in the stock market’s history, and most of them took years to recover.

- 1929: The Great Depression began that year when the stock market crashed due to investor fear and a weakening economy. Over 80% below peak values, the market bottomed out in 1932, and it took more than 20 years for it to recover.

- 1987: On Black Monday, the market experienced a 25% loss because of market decline, investor panic, and early algorithmic trading went wrong. The market did, however, bounce back within two years, and the Securities and Exchange Commission put in place circuit breakers and trading controls to stop panic selloffs.

- 2000: The Dot-Com Bubble burst in March 2000, following a spike in investments and speculative activity in internet-related businesses during the 1990s. It took seven years for the S&P 500 to rebound after a roughly 50% decline.

- 2008: The S&P 500 lost over half of its value as a result of the housing bubble and subprime lending crisis, and it took two years for it to recover.

- 2020: As COVID-19 spread over the world in February of that year, the market dropped by more than 30% in just over a month. However, the market had already recovered by August 2020, requiring six months to do so.

Trust Your Investments During a Stock Market Crash

A momentary dip or a short-term crash shouldn’t be an excuse to sell an investment. This is a great opportunity to handle your fears and not do anything out of fear. However, you can discover some compelling arguments to sell if you go back and review your first stock research notes.

This comprehensive stock analysis contains a written account of each investment. Their benefits, drawbacks, and intended use in your portfolio. It could also include the factors that might cause you to sell each of your investments. This study you make serves as a physical reminder of the qualities that make a stock worthwhile to hold, much like a road map for investing.

This guide can help you avoid removing a good long-term stock from your portfolio during a market downturn just because it had a terrible day. Understand your investments and trust them as much as you can. Focus on the long-term horizon even if your general strategy is to hold for the short-term. Crashes are the perfect opportunity to make even more money because you get to buy the dip.

Always Have Diversification

If you’ve spread your money over various baskets of asset types, such as equities and bonds, your outcomes may differ. This outcome will possibly for the better when the stock market crashes. Investing in a variety of investments, or diversifying your portfolio, is essential. It helps to lower investment risk and navigate a volatile market.

By diversifying, you can prevent your investments from becoming reliant on one sort of asset. Thus, if a particular stock or sector has a bad day, your other investments may help you recover some of your losses. If your portfolio has enough diversification, it’s best to remain calm and believe that your portfolio can weather the storm. You’ll still feel some unpleasant short-term shocks. However, you’ll be able to prevent losses that your portfolio won’t be able to recover.

Remember that diversification could come in different forms. You might invest in IT stocks in your stock portfolio, have physical real estate, commodities, and some bonds. This could still count as diversification. You can also buy from each sector that you believe in as stocks and make your overall stock portfolio spread over different sectors. You don’t have to own commodities, real estate, and bonds to create a perfect diversification strategy. Even though they help, there are other ways, too.

Buy and Hold When Everyone Sells

When the stock market crashes, the majority of people will sell off their investments, giving in to their fear. However, these stock market crashes can also present a chance to buy. Consider it as purchasing equities at a discount during a market crash. The key is to have the preparation for the decline and be ready to spend some money to purchase investments whose prices are falling.

It can be challenging to watch the value of your portfolio drop while taking no action or keep buying when the stock market crashes. Watching your portfolio decline in a year when you may have experienced illness, loss, or job loss due to the COVID-19 pandemic can be particularly difficult. After a crash, it’s common to feel pessimistic, but if you’re investing for the long term, staying put is frequently the smartest move.

Warren Buffet says, “The stock market is a device for transferring money from the impatient to the patient.” Be patient and keep buying when the markets drop. The point here is to keep buying the companies/ETFs that you trust. Do not buy random stocks in the hopes that they will go up. It could go bankrupt during that crash, and you might not recover your money. Buy companies that you think will survive the crash in the long run.

Do Not Make Panic Buys

We all know those who make panic sales during a market crash. You also make panic buys out of fear of missing out on big earnings. That’s why making panic purchases during a market crisis is vital to avoid. Panic buying state of mind can prevent you from achieving your present investment objectives when you buy out of panic.

After all, it looks like the best opportunity to invest at fair valuations is when the markets are down. Investors frequently acquire Index Funds or Blue-chip stocks in these circumstances. Even though buying a big company could make sense in a downturn, you still need to assess the situation well. Big companies like Microsoft, Apple, Johnson & Johnson, etc. could go down in a heartbeat just like they could go up the same way.

Spend more than you normally do when you are making a purchase during a market crash. Understand the company, its financials, and potential future. Most of the time, debts play a huge role in these times. If they have high debt that they can’t possibly recover when the revenues decline, they might be in trouble.

Many investors overlook their risk appetite when it comes to buying stocks during a stock market crash. Investors may invest in stocks above their real risk appetite because of the buying frenzy n the markets.

Rebalance Your Portfolio

To generate better risk-adjusted returns on your assets, portfolio rebalancing is a must. Rebalancing is a practice that help to lower the total risk in your investment portfolio. The rebalancing method focuses on making periodic purchases. You only sell your investments to keep the weight of each asset class consistent with your desired allocation.

To rebalance your portfolio, you must first have an asset allocation plan in place. A stock market crisis presents you with the ideal time to check your current investments if you don’t already have one. You can determine your current condition once you define goal allocations for various asset classes. After that, you can choose which securities you should buy or sell to achieve your asset allocation goal.

Rebalancing your portfolio can assist you in controlling portfolio risk during unpredictable market conditions. It can also help keeping you on track to meet your financial objectives. However, a rebalancing of your portfolio during a stock market crisis might not always be a wise idea. When you rebalance in the middle of a market crash, you sell the investments either at a loss or at a low profit than you would have if you were not in a market crash. Instead, you should think about waiting a little while before rebalancing your investing portfolio.