One of the most typical questions everyone trying to start in the investing world ask is the same. “How much of your income should you invest?” Rather a hard question to answer. The questions never end, though. Once you know how much to invest, you start asking other questions. You start asking yourself what assets to invest in, whether stocks, bonds, or other assets. These are hard questions. Learning about the answers might take time, effort, and mistakes.

It may be tempting to consider how much money you now have when deciding how much money to invest. You must also consider how much money you will need. Asking yourself, “What are my goals and what is my aim?” may not always be “pleasant” to do. With this knowledge in mind, you can use some “tried-and-true rules of thumb” to start. Most experts advise saving between 10% and 20% of your income after taxes. This number is for investments in stocks, bonds, and other assets. Not for putting in your bank account. However, your objectives and existing financial condition might need a different strategy.

If these questions seem familiar, congratulations on your foresight for your future. Investing not only increases your money, but it is also for retirement. You don’t need much to begin investing these days. Even a small amount could do the trick. The goal is to consistently contribute beyond your first commitment. You will have more money to grow over time.

What is a Good Amount of Money to Invest Each Month?

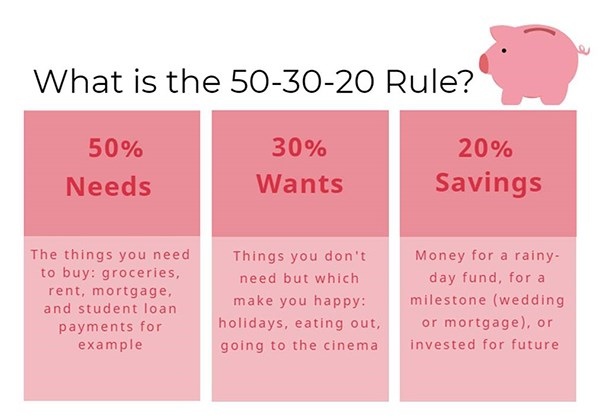

There is no set investment amount that is a fit for everyone. When determining how much of income to invest, everyone’s situation is unique. That is because everyone’s income and what they can afford to invest in different assets varies. Your aim also matters in determining what to do with your money. The biggest and most popular role many people use is the 50/30/20 rule.

There are other methods that you benefit from, too. A good starting point could be the most famous method. The 50/30/20 rule is a fantastic method to include savings into your monthly budget or spending plan. This budget also demands you consider your priorities. It also helps you to make decisions easier.

Another thing that you can try and execute is focusing on your aim. If you want to make a big purchase, your aim might be different than those you invest in for retirement. Considering percentages rather than a certain number is always better. If you can afford to invest 50%, you should invest 50%.

50/30/20 Rule

The 50/30/20 guideline proposes splitting your net income in a certain manner. 50 percent for needs, 30 percent for wants, and 20 percent for savings and debt repayment. The 20% in this method could either be funding for your emergency fund or investing. The aim with that 20% is to focus on your financial literacy and future. It could be short-term savings, like an emergency fund. Or long-term investments, like buying a property or investing in assets.

You need to automate the process when you know what to do for that 20%. It is critical to automate the transfer of that money to an investment account with each payment. That is, if you want to invest that 20% and not spend on another thing. The fact that you can only spend 50% may be unrealistic for many people. In these economical hardship times, most of your salary goes to needs. You definitely spend more than 50%.

This is even harder, particularly for those in their twenties. Because the salaries are way lower than the average market. You need to find the right balance by looking at your expenses. That is why I mentioned that there is no fit for everyone. Most of the tactics out here could be rubbish for you. Taking the 50/30/20 rule as the main starting point could be beneficial to understanding how things work.

Finding Your Own Balance

As I said above, spending only 50% on needs might seem unrealistic for many. You probably spend way more than that. Remember that this is normal if this is the case. There is always room for growth and finding balance. You have to understand yourself perfectly to make plans to balance your investing.

However, finding that balance might be hard. Especially in the early years of your career. Many people can’t find the budget at all. Your road will gradually increase if you are in the early times of your career. You might need to increase your savings target over the years in your early career. It is also acceptable to put off investing your entire available money to prioritize other, shorter-term goals. This could be debt repayment or buying a home. Childbirth or giving oneself the freedom to take a career break is also important.

It’s quite challenging for folks with higher student loan loads to reach the 20% criterion. You must look at your situation before deciding on your investing journey. Remember that you don’t need hundreds of dollars to start investing. Even 10$ a month is a good start. Your financial condition will change with your work and personal life progression. The same is true for your investments. Aim to set away even more of your earnings for investing and saving when there is higher inflation. This is the case in the U.S. economy at the moment.

Finally, keep in mind that your investment objectives may alter in the future. Reviewing your plan every year could be a good idea. Checking to see if you will have any extra cash to put toward investments at the end of the year could also be a good plan.

How Much Should I Invest at My Age?

According to Fidelity Investments, you should save ten times your salary if you want to retire by age 67. If you want to retire at one time, you can adjust this amount. Those who retire at the age of 62 (the earliest you may claim Social Security) would need to save more than that. That’s because you need to make up for an extra five years with no income. Those retiring at 70 are unlikely to need the whole ten times their salary. Because they will have worked an extra three years and will have fewer years to spend on their assets.

But all these are just numbers. Not everybody is fortunate enough to invest all those years without interruption. There is also the factor of different goals and aims in life. One might want to just buy a house but keep working for more. Like everything else about this topic, this also falls on you. You should understand what you need and want. Investing only to retire early could be a bad idea. Investing might provide you with good value and protect your money. But it will unlikely to make you extremely rich in a short time.

Here are the amounts you should invest at each age:

- By the age of 30, you should have your annual salary as your savings.

- When you are 40, more than three times your income

- By the age of 50, more than six times your income

- When you turn 60, more than eight times your income

- By the age of 67, more than ten times your income

How Much Should You Invest to Make Money?

When deciding how much of your income should you invest, it is tempting to consider how much wealth you have. Yet, you must also consider how much money you would need. Though, it is not always fun to consider it. Ask yourself, “What are my objectives, and what am I aiming to achieve?”

With this information in hand, you may use some “tried-and-true rules of thumb” to start. Experts advise setting aside 10% to 20% of your net income for investing in assets. Your present financial condition and aspirations may need a different strategy. Not everybody earns enough to make a 10% count.

Your financial condition matter to get to the levels to make money. If your salary is not good enough, investing 10% might not give you a good return. Even though it is important to just start, how much you invest matters in the long run. However, you must remember that you will put this money right away, but you won’t see results anytime soon. It will happen in time, not immediately. The capital you need will be much lower than your ending point. Your capital will increase along with your income if you choose to invest in the right assets.

What is Your Aim?

Making money through your investments is not easy. It requires massive capital and time. You can’t expect to make money next month after you start investing. However, it is possible to shorten the time if your aims differ from others. This is easier if you aim to cover only certain expenses such as groceries and annual holidays. It will also take less time. If your aim is to cover your entire spending, you will need to wait a few decades. You also will need to make a constant contribution.

As an example, let’s say you have a dividend portfolio with a 3% yield. If you have $1 million in capital, you could expect to earn $30,000 annually. This number might be enough for some goals. The country or the state you live in also affects how much you need. As a general rule of thumb, $30,000 annually is nothing in a big state in the United States. If you are in Thailand, this is a lot of money. When your aim is to only cover your annual holidays, this number could again be enough. However, if you want to cover your entire spending, $30,000 is nothing.

Should You Invest Your Savings?

Your savings and your investments must be different. This is one of the most frequent and biggest mistakes many people do. Your saving is there to cover unexpected costs. Any investment you make might not be there tomorrow when you need it. However, your saving in cash will be there. That is why you must save first and then invest.

Doing the second one before the first one is a huge mistake. You never know what life will bring. Being prepared for that will also help you to keep investing in case of an unexpected event. Liquidating your assets to cover unexpected costs is not the best scenario. That is because when you have been investing for a while, your cost basis will be lower than the market price. You will avoid selling at a loss if it is higher than the market price.

Your investments will always be more dangerous than the cash in your emergency fund. Set a certain emergency fund for six or twelve months of expenses and invest the rest. Never make the mistake of investing your savings into an asset. They might deteriorate in value, and might take time for them to recover. Having at least twelve months of cash sitting in your bank account will also ease your mind. In case of unemployment, health costs, or anything else, you’ll be ready.

Is Emergency Fund Really Necessary and Should You Keep it in Cash?

Having an emergency fund in cash is more necessary than investing. Investing is just a benefit to a good financial situation. You invest in making your financial situation better. You don’t invest in getting rich quick. Find this fine line and understand it fully. That is why having an emergency fund is the number one priority for everyone.

That emergency fund must either sit in cash or in a high-yielding account. The main aim of an emergency fund is that you can reach it right away, and it will not decrease in value. If there is even a slight risk of value decreasing in your emergency fund, you are at risk. Always have an emergency fund before you invest. And always keep it in cash.

The reason to keep it in cash is pretty obvious. You will need it fast if you have to pay for something immediately. When you invest that money, it will take a while to sell it and get it liquidated. However, the most important part of not investing in an emergency fund is not this. It is because any investment you will make is risky. That risk will put your financial situation at risk, as well.